The mortgage may contain an option to “reset” the interest rate to the current market rate and to extend the due date if certain conditions are met.īalloon Payment: A final lump sum payment that is due, often at the maturity date of a balloon mortgage.īankruptcy: Legally declared unable to pay your debts.

Real estate lingo listing manual#

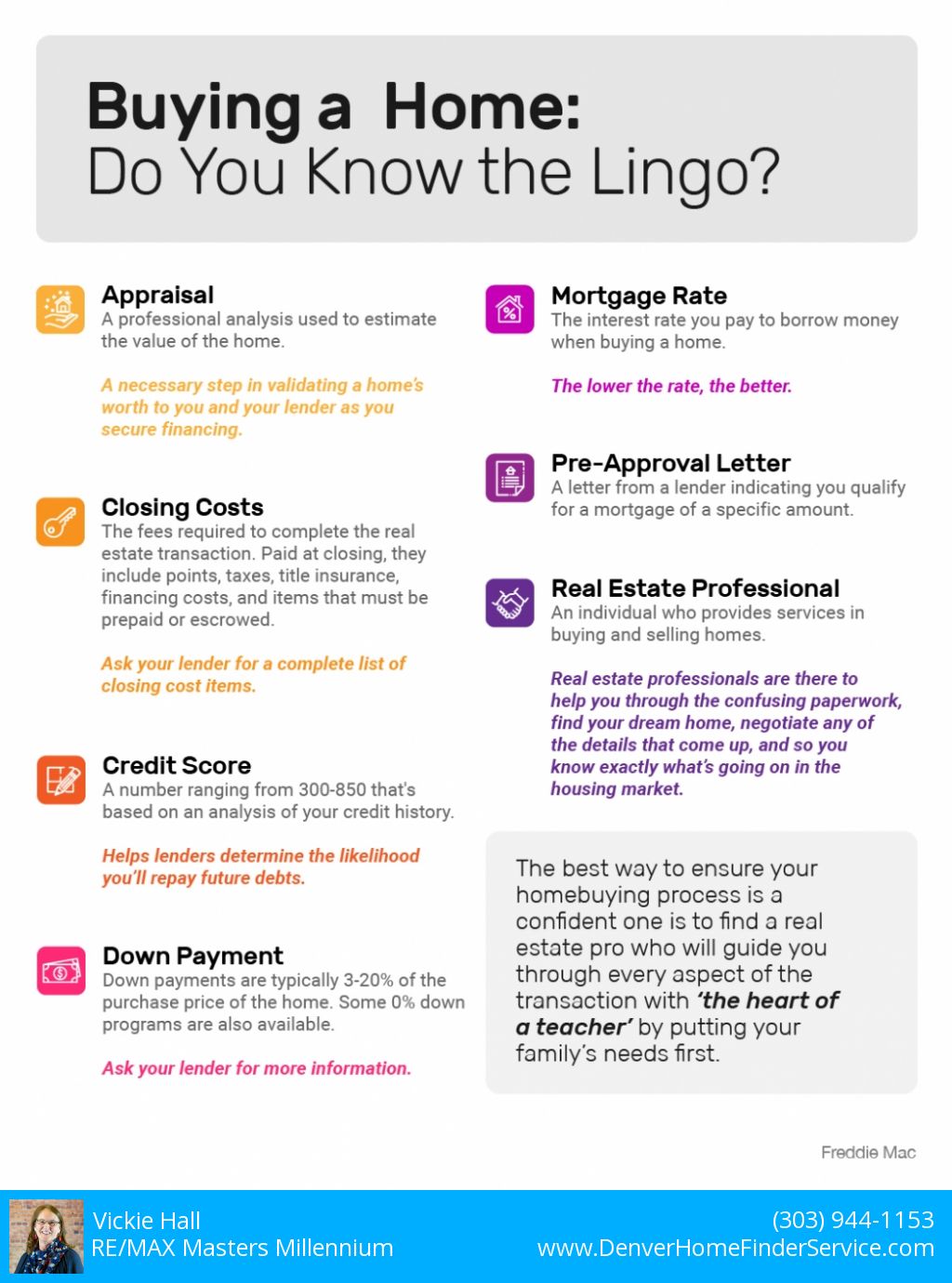

If the mortgage contains a due-on-sale clause, the loan may not be assumed without the lender’s consent.Īssumption: A homebuyer’s agreement to take on the primary responsibility for paying an existing mortgage from a home seller.Īssumption Fee: A fee a lender charges a buyer who will assume the seller’s existing mortgage.Īutomated Underwriting: An automated process performed by a technology application that streamlines the processing of loan applications and provides a recommendation to the lender to approve the loan or refer it for manual underwriting.īalance Sheet: A financial statement that shows assets, liabilities, and net worth as of a specific date.īalloon Mortgage: A mortgage with monthly payments often based on a 30-year amortization schedule, with the unpaid balance due in a lump sum payment at the end of a specific period of time (usually 5 or 7 years). An assumption of a mortgage is a transaction in which the buyer of real property takes over the seller’s existing mortgage the seller remains liable unless released by the lender from the obligation. Assets include real property, personal property, stocks, mutual funds, etc.Īssignment of Mortgage: A document evidencing the transfer of ownership ofa mortgage from one person to another.Īssumable Mortgage: A mortgage loan that can be taken over (assumed) by the buyer when a home is sold. However, some older homes may still have asbestos in these materials.Īssessed Value: Typically the value placed on property for the purpose of taxation.Īssessor: A public official who establishes the value of a property for taxation purposes.Īsset: Anything of monetary value that is owned by a person or company. Because some forms of asbestos have been linked to certain lung diseases, it is no longer used in new homes. There is a hearing where both parties have an opportunity to be heard, after which the arbitrator makes a decision.Īsbestos: A toxic material that was once used in housing insulation and fireproofing. The disputing parties agree in advance to agree with the decision of the arbitrator. The analysis is called an “appraisal.”Īppreciation: An increase in the market value of a home due to changing market conditions and/or home improvements.Īrbitration: A process where disputes are settled by referring them to a fair and neutral third party (arbitrator).

Real estate lingo listing professional#

This includes examples of sales of similar properties.Īppraiser: A professional who conducts an analysis of the property, including examples of sales of similar properties in order to develop an estimate of the value of the property.

Also, a type of insurance policy in which the policy holder makes payments for a fixed period or until a stated age, and then receives annuity payments from the insurance company.Īpplication Fee: The fee that a mortgage lender or broker charges to apply for a mortgage to cover processing costs.Īppraisal: A professional analysis used to estimate the value of the property. The APR includes the interest rate, points, broker fees and certain other credit charges a borrower is required to pay.Īnnuity: An amount paid yearly or at other regular intervals, often at a guaranteed minimum amount. After that period ends, interest rates - and your monthly payments - can go lower or higher.Īffordability: A buyer’s financial state of being in relation to the price of homes they are considering for purchase.Īnnual Percentage Rate (APR): The cost of a loan or other financing as an annual rate. Generally, the initial interest rate is lower than that of a comparable fixed-rate mortgage. This means that the monthly payments can go up or down. It is calculated by dividing the number of homes sold in the allotted time period by the total number of available homes.Īdjustable Rate Mortgage (ARM): A home loan with an interest rate that can change periodically. Absorption Rate: A metric used in the real estate market to evaluate the rate at which available homes are sold in a specific market during a given time period.

0 kommentar(er)

0 kommentar(er)